Property market report 2023-24

Published: 25 June 202420 year review of the Scottish property market.

Documents

Registers of Scotland Property Market Report 2024 - (581.3 KB)Data tables - Property Market Report 2023-2024 - (324.8 KB)

Main findings

Table of contents

Introduction

Below are the main findings of the Property Market Report 2023-24, reviewing 20 years of trends in residential and non-residential property sales from 2003-04 to 2023-24.

More charts and visualisations of the data are also available via our Tableau page.

Previous reports can be viewed via our publications.

Residential market: Overview and distribution of sales

Following the introduction of median house prices to last year’s report and online data tables, this year’s report uses medians as the primary measure for average house price to replace the arithmetic mean.

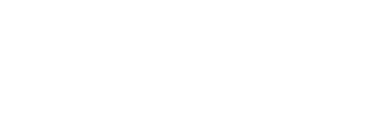

| Scotland | % change | ||||

|---|---|---|---|---|---|

| 2023-24 | 1 year | 5 year | 10 year | 20 year | |

| Volume of sales | 93,429 | -8% | -9% | 7% | -33% |

| Median price | £185,000 | 0% | 22% | 42% | 147% |

| Market value | £20.7 billion | -8% | 12% | 49% | 56% |

In 2023-24:

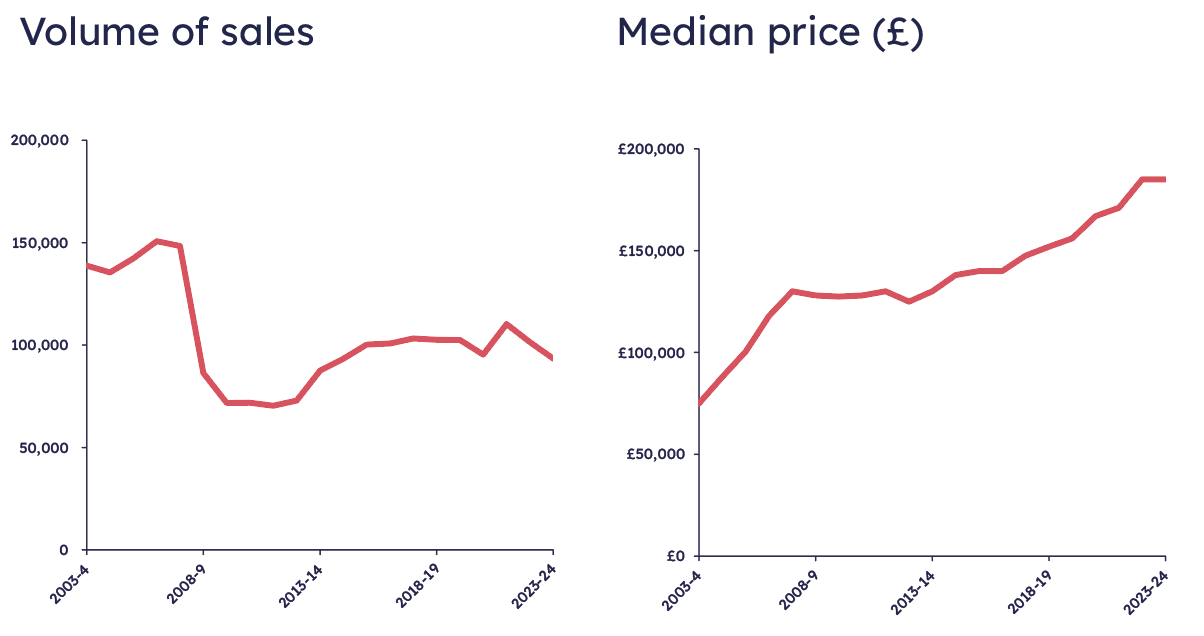

- around two thirds of residential property sales in Scotland were between £40,000 and £250,000

- there were 404 residential sales priced over £1 million across Scotland, down slightly on the 427 sales in 2022-23

- East Renfrewshire had the widest range of prices with 60% of sales lying between £160,000 and £455,000

- Na h-Eileanan Siar has the narrowest range of residential sale prices, with 60% of sales falling between £106,000 and £215,000

Volume and average price of residential property sales, Scotland, 2003-04 to 2022-23, financial year data.

Figure 1: Volume of residential sales in Scotland by price band 2023/24, data table 8

More information on this section is available in chapter 1.1 of the full report.

House type

- In 2023-24, detached properties had the highest median price of all property types, £305,000, and flats the lowest, £128,500.

- Although flats had the highest volume of sales, over the past 10 years flats have shown the slowest growth in prices at 29%, compared with around 41-48% for other house types.

| Detached | Semi-detached | Terraced | Flat | |

|---|---|---|---|---|

| Volume of sales | 18,497 | 15,179 | 18,210 | 34,285 |

| Market value (million) | £6,299 | £3,278 | £3,354 | £5,556 |

| Median price | £305,000 | £192,000 | £148,000 | £128,500 |

| Median % changes | ||||

| 5 year | 25% | 24% | 18% | 12% |

| 10 year | 42% | 48% | 41% | 29% |

| 20 year | 118% | 140% | 160% | 114% |

More information on this section is available in chapter 1.2 of the full report.

New builds

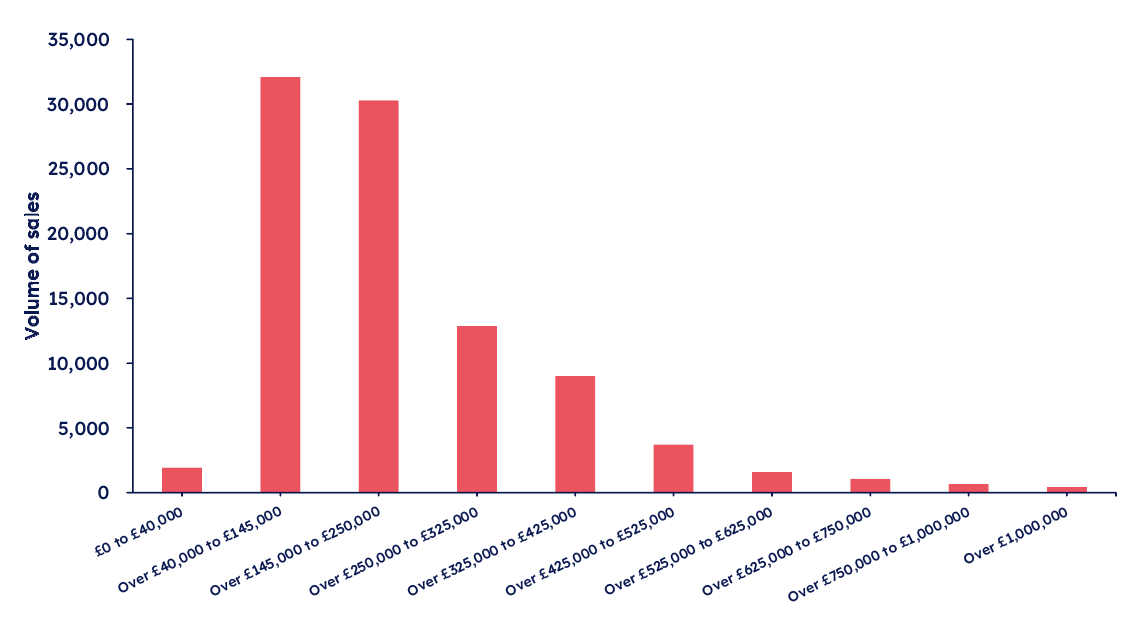

In 2023-24:

- there were 9,867 new build residential property sales in Scotland, 20% less than in 2022-23; 11% of residential property sales in Scotland were new builds

- the median price of a new build property in Scotland was £300,000, 5% higher than 2022-23 and 62% higher than the overall median for Scotland of £185,000

- the value of the new build residential property market in Scotland was £3.3 billion

Figure 2: Average residential property price for new builds and all residential properties, Scotland 2003-04 to 2023-24, data table 15

More information on this section is available in section 1.3 of the full report.

Cities

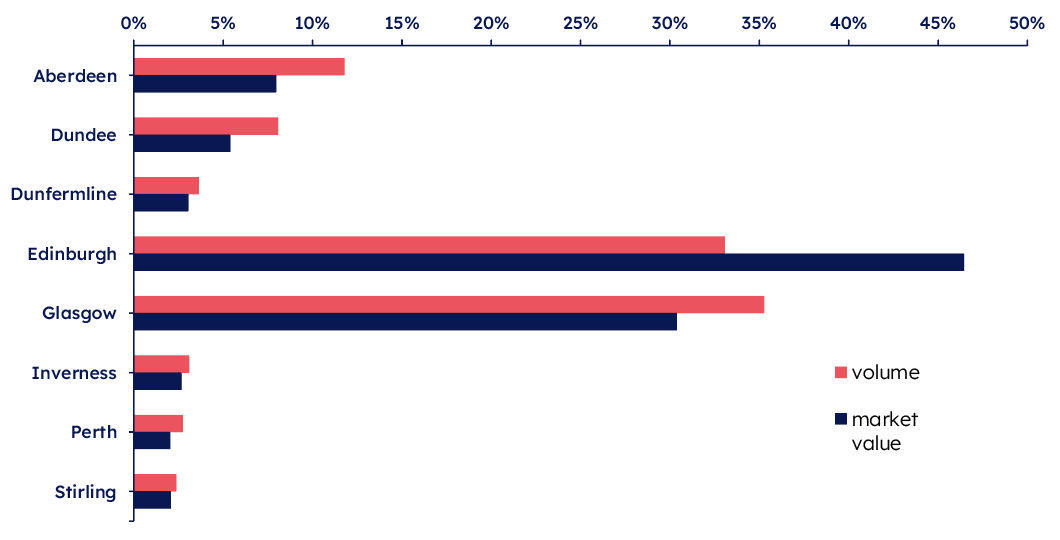

- In 2023-24, the city market accounted for 31% of all residential property sales in Scotland.

- Over the past 20 years, the growth in prices in every city has been slower than the price growth in the rest of Scotland.

- The volume of sales fell in the last year in every city, by more than the drop in sales for the rest of Scotland.

- Edinburgh had the highest median price in 2023-24 at £265,000 and Aberdeen had the lowest at £127,250.

Figure 3: Percentage of city residential property sales transactions & market value, data tables 28 & 30.

More information on this section is available in section 1.4 of the full report.

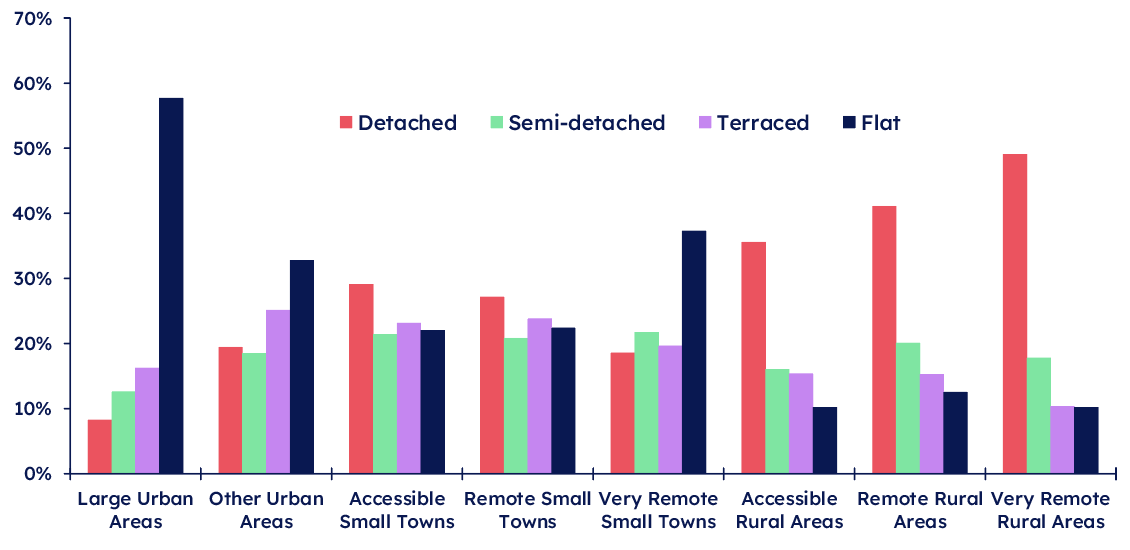

Urban Rural

- Accessible rural areas had the highest median price of all areas in 2023-24 at £265,000 and have shown the highest price growth in the last 5 years with 38% growth; accessible rural areas have consistently shown the highest prices every year for the past 5 years .

- The mix of residential property sales in rural areas is different to urban areas, with urban areas having a much larger proportion of flats, and rural areas more detached houses; this affects the median prices since flats tend to be cheaper than detached houses.

- Although the overall median for accessible rural areas was significantly higher than for urban areas, the median price for each property type in accessible rural areas was lower than in large urban areas.

Figure 4: Percentage of sales by house type and urban rural classification, data table 38.

More information on this section is available in section 1.5 of the full report.

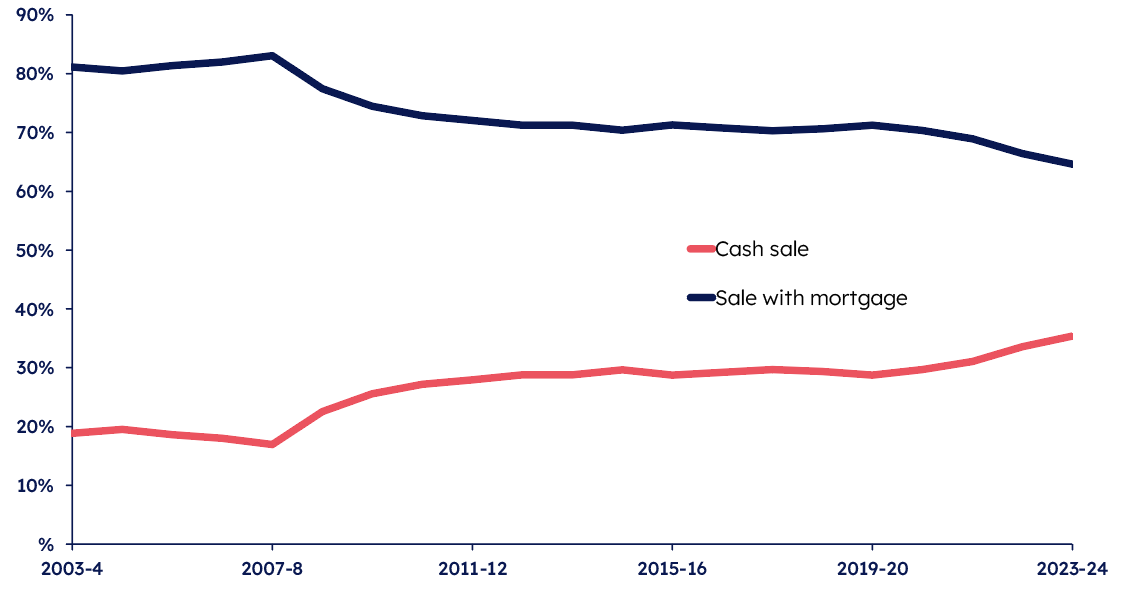

Mortgage market and cash sales

In 2023-24:

- the volume of residential sales with a mortgage was 59,367, 64% of the residential market

- the volume of residential cash sales was 34,930, 36% of the residential market

- the volume of all mortgage securities registered by RoS across all property types, including both mortgage sales and remortgage/additional borrowing, was 99,233, a decrease of 23% when compared with 2022-23

Figure 5: Sales volume by funding status, data table 42.

More information on this section is available in section 02 of the full report.

Non-residential market

In 2023-24:

- there were 7,514 non-residential sales with a total market value of £3.6 billion

- there were 4,257 commercial sales, an increase of 1% from 2022-23

- there were 757 commercial leases, an increase of 11% from 2022-23

| Commercial | Forestry | Agriculture | Land | |

|---|---|---|---|---|

| Volume of sales | 4,257 | 89 | 531 | 2,637 |

| Market value (£ million) | 2,984 | 52 | 220 | 365 |

| Market value as % of non-residential total | 82.4% | 1.4% | 6.1% | 10.1% |

More information on this section is available in section 03 of the full report.